The Research Wizard comes loaded with multiple databases, up to 12 years of historical data, and over 650 different fundamental data items to pick and choose from.

The main screening database (DBCM database) has over 425 different data items just in that database alone.

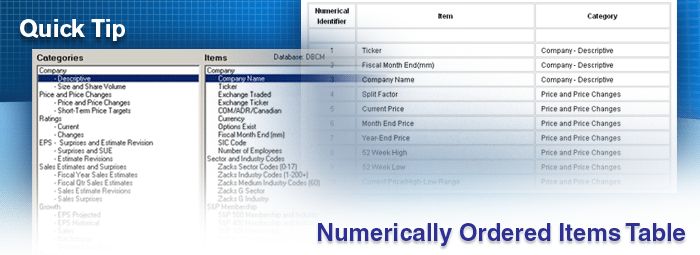

All of the data is smartly organized by Categories and then Items with plain language descriptions. Each item is also assigned a numerical identifier.

Grouping them by Categories and then Items is the most logical way to quickly find what you're looking for.

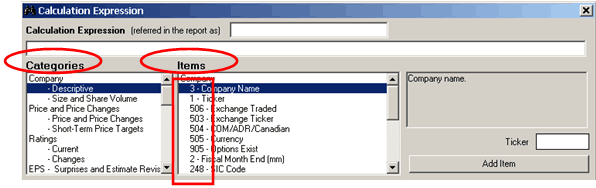

But, once you've create a Calculation Expression, only the numerical identifier will be shown.

So, when trying to determine what items are being referenced in a Calculated Expression, it's helpful to have all of the items arranged in numerical order and then by Items and Category.

The reverse item lookup in numerical order provided below will come in handy in these instances.

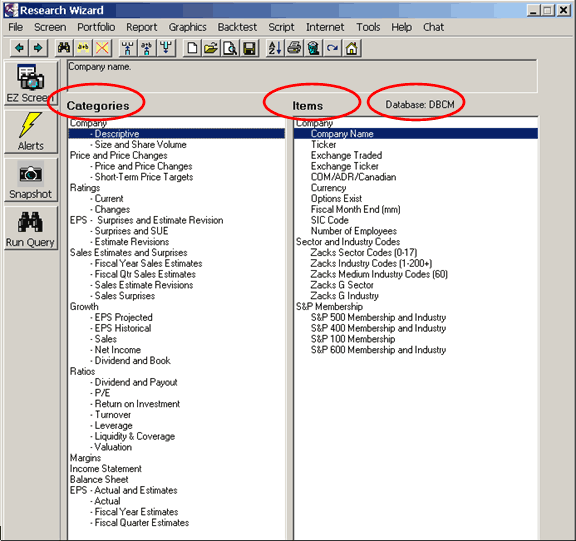

Categories and Items

Below is a snapshot of the main page showing the Categories and Items windows with the active DBCM database.

Below is how that same database looks in the Calculation Expression window. (Notice the numerical identifiers in front of each item.)

Here's an example of a Calculation Expression:

i106 >= i170

This appears in one of our predefined screens named:

bt_sow_increasing cash flows

Use the table below to look up each item (item 106 and item 170) to see what the calculation is referencing.

And refer back to it again and again for easy lookups.

DBCM Database

| Numerical Identifier |

Item | Category |

| 1 | Ticker | Company - Descriptive |

| 2 | Fiscal Month End(mm) | Company - Descriptive |

| 3 | Company Name | Company - Descriptive |

| 4 | Split Factor | Price and Price Changes |

| 5 | Current Price | Price and Price Changes |

| 6 | Month End Price | Price and Price Changes |

| 7 | Year-End Price | Price and Price Changes |

| 8 | 52 Week High | Price and Price Changes |

| 9 | 52 Week Low | Price and Price Changes |

| 10 | Current Price/High-Low Range | Price and Price Changes |

| 11 | % Change Price - 4 Weeks | Price and Price Changes |

| 13 | % Change Price - 12 Weeks | Price and Price Changes |

| 15 | % Change Price - 24 Weeks | Price and Price Changes |

| 18 | Rel % Change Price - YTD | Price and Price Changes |

| 19 | Beta | Price and Price Changes |

| 20 | Shares Outstanding (mil) | Company - Size and Share Volume |

| 21 | Market Value ($mil) | Company - Size and Share Volume |

| 22 | Volume - 20 Days (shares) | Company - Size and Share Volume |

| 23 | Indicated Annual Dividend | Ratios - Dividend and Payout |

| 24 | 5 Year Historical Dividend Growth (%) | Growth - Dividend and Book |

| 25 | R-squared Historical Dividend Growth | Growth - Dividend and Book |

| 25 | R-squared Dividend Growth | Ratios - Valuation |

| 26 | Current Dividend Yield (%) | Ratios - Dividend and Payout |

| 27 | 5 Year Average Dividend Yield (%) | Ratios - Dividend and Payout |

| 28 | EPS Before NRI ($/share) - Quarterly | EPS - Actuals & Est. - Actual |

| 29 | Last Reported Fiscal Quarter (yyyymm) | EPS - Actuals & Est. - Actual |

| 30 | Last Completed Fiscal Quarter (yyyymm) | EPS - Actuals & Est. - Actual |

| 30 | Q(0) Fiscal Quarter End Date (yyyymm) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 31 | EPS Before NRI ($/share) - Annual | EPS - Actuals & Est. - Actual |

| 32 | Last Reported Fiscal Year (yyyymm) | EPS - Actuals & Est. - Actual |

| 33 | Last Completed Fiscal Year (yyyymm) | EPS - Actuals & Est. - Actual |

| 33 | F(0) Year End Date (yyyymm) | EPS - Actuals & Est. - Fiscal Yr Est |

| 34 | Actual EPS used in 12 mo ($/share) | EPS - Suprises and SUE |

| 34 | 12 month EPS Before NRI ($/share) | EPS - Actuals & Est. - Actual |

| 35 | 5 Year Historical EPS Growth (%) | Growth - EPS Historical |

| 36 | R-squared Historical EPS Growth | Growth - EPS Historical |

| 36 | R-squared EPS Growth | Ratios - Valuation |

| 37 | Standardized Unexpected Earnings | EPS - Suprises and SUE |

| 38 | Predicted EPS used in 12 mo ($/share) | EPS - Suprises and SUE |

| 39 | Q(0) Consensus Estimate ($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 40 | Q(0) Std Dev of Consensus | EPS - Actuals & Est. - Fiscal Qtr Est |

| 41 | EPS Suprises (%) | EPS - Suprises and SUE |

| 42 | Q(1) Consensus Estimate ($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 43 | Q(1) Std Dev of Consensus | EPS - Actuals & Est. - Fiscal Qtr Est |

| 44 | % Change Q(1) Est - 4 Weeks | EPS - Estimate Revisions |

| 45 | Q(1) # Analysts in Consensus | EPS - Actuals & Est. - Fiscal Qtr Est |

| 46 | Q(2) Consensus Estimate ($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 47 | Q(2) Std Dev of Consensus | EPS - Actuals & Est. - Fiscal Qtr Est |

| 48 | Q(2) # Analysts in Consensus | EPS - Actuals & Est. - Fiscal Qtr Est |

| 49 | F(1) Consensus Estimate ($/share) | EPS - Actuals & Est. - Fiscal Yr Est |

| 50 | F(1) Highest Estimate in Cons($/share) | EPS - Actuals & Est. - Fiscal Yr Est |

| 51 | F(1) Lowest Estimate in Cons($/share) | EPS - Actuals & Est. - Fiscal Yr Est |

| 52 | F(1) Std Dev of Consensus | EPS - Actuals & Est. - Fiscal Yr Est |

| 53 | % Change F(1) Est - 1 Week | EPS - Estimate Revisions |

| 54 | % Change F(1) Est - 4 Weeks | EPS - Estimate Revisions |

| 55 | % Change F(1) Est - 12 Weeks | EPS - Estimate Revisions |

| 56 | # Up F(1) Est - 4 Weeks | EPS - Estimate Revisions |

| 57 | # Down F(1) Est - 4 Weeks | EPS - Estimate Revisions |

| 58 | F(1) # Analysts in Consensus | EPS - Actuals & Est. - Fiscal Yr Est |

| 59 | F(2) Consensus Estimate in Cons($/share) | EPS - Actuals & Est. - Fiscal Yr Est |

| 60 | F(2) Consensus Estimate ($/share) | EPS - Actuals & Est. - Fiscal Yr Est |

| 61 | F(2) Lowest Estimate in Cons ($/share) | EPS - Actuals & Est. - Fiscal Yr Est |

| 62 | F(2) Std Dev of Consensus | EPS - Actuals & Est. - Fiscal Yr Est |

| 63 | % Change F(2) Est - 4 Weeks | EPS - Estimate Revisions |

| 64 | % Change F(2) Est - 12 Weeks | EPS - Estimate Revisions |

| 65 | # Up F(2) Est - 4 Weeks | EPS - Estimate Revisions |

| 66 | # Down F(2) Est - 4 Weeks | EPS - Estimate Revisions |

| 66 | Change in Pretax Mgn. (12 mo-5Yr Avg) | Margins |

| 67 | F(2) # Analysts in Consensus | EPS - Actuals & Est. - Fiscal Yr Est |

| 68 | Next 3-5 Years Est EPS Growth (%/yr) | Growth - EPS Projected |

| 69 | St Dev of LT EPS Growth Estimates | Growth - EPS Projected |

| 70 | % Change LT EPS Gr. Est - 12 Weeks | EPS - Estimate Revisions |

| 71 | # Analysts in Growth Consensus | Growth - EPS Projected |

| 72 | P/E using F(1) Estimate | Ratios - P/E |

| 73 | Rel P/E using F(1) Estimate | Ratios - P/E |

| 74 | P/E using F(2) Estimate | Ratios - P/E |

| 75 | Rel P/E using F(2) Estimate | Ratios - P/E |

| 76 | P/E using 12 month EPS | Ratios - P/E |

| 77 | Rel P/E using 12 month EPS | Ratios - P/E |

| 78 | P/E 12 month - 5 year High | Ratios - P/E |

| 79 | P/E 12 month - 5 year Low | Ratios - P/E |

| 80 | Sales ($mil) | Company - Size and Share Volume |

| 80 | Sales ($mil) | Income Statement |

| 81 | 5 Year Historical EPS Sales Growth (%) | Growth - Sales |

| 82 | R-squared Historical Sales Growth | Growth - Sales |

| 82 | R-squared Sales Growth | Ratios - Valuation |

| 83 | Cost of Goods Sold ($mil) | Income Statement |

| 84 | Pretax Income ($mil) | Income Statement |

| 85 | Net Income Reported ($mil) | Income Statement |

| 86 | Receivables ($mil) | Balance Sheet |

| 87 | Inventory ($mil) | Balance Sheet |

| 88 | Total Current Assets ($mil) | Balance Sheet |

| 89 | Total Current Liabilities ($mil) | Balance Sheet |

| 90 | Long Term Debt ($mil) | Balance Sheet |

| 91 | Preferred Equity ($mil) | Balance Sheet |

| 92 | Common Equity ($mil) | Balance Sheet |

| 93 | ROE - Most Recent 12 months (%) | Ratios - Return on Investment |

| 94 | ROE - Average Last 5 years (%) | Ratios - Return on Investment |

| 95 | ROA - Most Recent 12 months (%) | Ratios - Return on Investment |

| 96 | ROA - Average Last 5 years (%) | Ratios - Return on Investment |

| 97 | Book Value ($/share) | Balance Sheet |

| 98 | 5 Year hist. Book Value Growth (%) | Growth - Dividend and Book |

| 99 | R-squared Historical Book Value Gowth | Growth - Dividend and Book |

| 100 | Price/Book (Common Equity) | Ratios - Valuation |

| 101 | Most Recent Payout Ratio | Ratios - Dividend and Payout |

| 102 | 5 Year Average Payout Ratio | Ratios - Dividend and Payout |

| 103 | Pretax Margin 12 mo. Most Recent (%) | Margins |

| 104 | Pretax Margin - Average Last 5 Years | Margins |

| 105 | Cash Flow ($mil) | Income Statement |

| 106 | Cash Flow ($/share) | Ratios - Valuation |

| 107 | Price/Cash Flow | Ratios - Valuation |

| 112 | F(0) Consensus Estimate ($/share) | EPS - Actuals & Est. - Fiscal Yr Est |

| 113 | F(0) Std Dev of Consensus | EPS - Actuals & Est. - Fiscal Yr Est |

| 114 | F(0) # Analysts in Consensus | EPS - Actuals & Est. - Fiscal Yr Est |

| 117 | Zacks Industry Codes (1-200+) | Company - Descriptive |

| 120 | % Change Price - 1 Week | Price and Price Changes |

| 122 | % Change Price - 52 Weeks | Price and Price Changes |

| 124 | P/E 12 month - 5 year Average | Ratios - P/E |

| 125 | Q(1) Median Estimate ($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 126 | Q(2) Median Estimate ($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 127 | F(1) Median Estimate ($/share) | EPS - Actuals & Est. - Fiscal Yr Est |

| 128 | F(2) Median Estimate ($/share) | EPS - Actuals & Est. - Fiscal Yr Est |

| 129 | Median EPS LT Estimate Growth (%) | Growth - EPS Projected |

| 130 | Q(3) Consensus Estimate ($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 131 | Q(3) # Analysts in Consensus | EPS - Actuals & Est. - Fiscal Qtr Est |

| 132 | Q(4) Consensus Estimates ($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 133 | Q(4) # Analysts in Consensus | EPS - Actuals & Est. - Fiscal Qtr Est |

| 134 | F(3) Consensus Estimate ($/share) | EPS - Actuals & Est. - Fiscal Yr Est |

| 135 | F(3) # Analysts in Consensus | EPS - Actuals & Est. - Fiscal Yr Est |

| 136 | Average Broker Rating | Ratings - Current |

| 137 | # in Av Broker Rating | Ratings - Current |

| 138 | # Rating Strong Buy | Ratings - Current |

| 139 | # Rating Buy | Ratings - Current |

| 140 | # Rating Hold | Ratings - Current |

| 141 | # Rating Sell | Ratings - Current |

| 142 | # Rating Strong Sell | Ratings - Current |

| 143 | # No Rating (broker rating) | Ratings - Current |

| 144 | # Rating Upgrades - 1 Week | Ratings - Changes |

| 145 | # Rating Downgrades - 1 Week | Ratings - Changes |

| 146 | # Rating Upgrades - 4 Weeks | Ratings - Changes |

| 147 | # Rating Downgrades - 4 Weeks | Ratings - Changes |

| 148 | Last Ex-Dividend Amount ($/sh) | Ratios - Dividend and Payout |

| 149 | Last Ex-Dividend Date (yyyymmdd) | Ratios - Dividend and Payout |

| 150 | Sales - Quarterly ($mil) | Income Statement |

| 151 | Net Income Before NRI - Qtr. ($mil) | Income Statement |

| 152 | Net Income Reported - Quarterly ($mil) | Income Statement |

| 153 | Net EPS ($/share) Quarterly | Income Statement |

| 154 | Last EPS Report Date (yyyymmdd) | EPS - Actuals & Est. - Actual |

| 155 | Sales - 12 months ($mil) | Income Statement |

| 156 | Net Income Before NRI - 12 mo. ($mil) | Income Statement |

| 157 | Net Income Reported -12 mo. ($mil) | Income Statement |

| 158 | Cash and Marketable Secs - Qtr ($mil) | Balance Sheet |

| 159 | Receivables - Quarterly ($mil) | Balance Sheet |

| 160 | Inventory - Quarterly ($mil) | Balance Sheet |

| 161 | Current Assets - Quarterly | Balance Sheet |

| 162 | Total Assets - Quarterly ($mil) | Balance Sheet |

| 163 | Current Liabilities - Quarterly ($mil) | Balance Sheet |

| 164 | Total Long Term Debt - Qtr ($mil) | Balance Sheet |

| 165 | Total Liabilities - Quarterly ($mil) | Balance Sheet |

| 166 | Minority Interest - Quarterly ($mil) | Balance Sheet |

| 167 | Preferred Equity - Quarterly ($mil) | Balance Sheet |

| 168 | Common Equity - Quarterly ($mil) | Balance Sheet |

| 169 | Book Value ($/share) - Quarterly | Balance Sheet |

| 170 | 5 Year Average Cash Flow ($/share) | Growth - Dividend and Book |

| 171 | ROI - Most Recent 12 months (%) | Ratios - Return on Investment |

| 172 | ROI - Average Last 5 years (%) | Ratios - Return on Investment |

| 173 | Net Margin 12 mo. - Most Recent (%) | Margins |

| 174 | Net Margin - Average Last 5 Years | Margins |

| 175 | Oper. Margin 12 mo - Most Recent (%) | Margins |

| 176 | Oper. Margin - Average Last 5 Years | Margins |

| 177 | Rec. Turnover - Most Recent | Ratios - Turnover |

| 178 | Rec. Turnover - Avg. Last 5 Yr. | Ratios - Turnover |

| 179 | Inventory Turnover - Most Recent | Ratios - Turnover |

| 180 | Inventory Turnover - Avg. Last 5 Yr | Ratios - Turnover |

| 181 | Asset Utilitzation - Most Recent | Ratios - Turnover |

| 182 | Asset Utilization - Avg. last 5 Yr. | Ratios - Turnover |

| 183 | Current Ratio - Most Recent | Ratios - Liquidity & Coverage |

| 184 | Current Ratio - Average Last 5 Yr. | Ratios - Liquidity & Coverage |

| 185 | Debt/Total Capital - Most Recent (%) | Ratios - Leverage |

| 186 | Debt/Tot. Capital - Avg. Last 5 Yr (%) | Ratios - Leverage |

| 187 | % Change Q(0) Est - 4 Weeks | EPS - Estimate Revisions |

| 188 | Q(0) # Analysts in Consensus | EPS - Actuals & Est. - Fiscal Qtr Est |

| 189 | Next EPS Report Date (yyyymmdd) | EPS - Actuals & Est. - Actual |

| 191 | Zacks Sector Codes (0-17) | Company - Descriptive |

| 192 | Zacks Rank | Ratings - Current |

| 193 | % Change Q(2) Est - 4 Weeks | EPS - Estimate Revisions |

| 194 | % Change LT EPS Gr. Est - 4 Weeks | EPS - Estimate Revisions |

| 196 | Short Ratio | Company - Size and Share Volume |

| 197 | Q(1) Highest Estimate in Cons($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 198 | Q(1) Lowest Estimate in Cons($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 199 | Q(2) Highest Estimate in Cons($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 200 | Q(2) Lowest estimate in Cons($/share) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 201 | Diluted Net EPS ($/share) | Income Statement |

| 202 | Actual EPS used in Surprise ($/sh) | EPS - Suprises and SUE |

| 203 | Zacks Medium Industry Codes (60) | Company - Descriptive |

| 206 | Earnings Before Int & Txs (EBIT) | Income Statement |

| 207 | Earnings Bfr Int Tx Dep & Am (EBITDA) | Income Statement |

| 208 | Zacks G Sector | Company - Descriptive |

| 209 | Zacks G Industry | Company - Descriptive |

| 210 | Intangibles - Quarterly ($mil) | Balance Sheet |

| 211 | Intangibles ($mil) | Balance Sheet |

| 212 | Interest Coverage | Ratios - Liquidity & Coverage |

| 214 | Q(0) Consensus Sales Estimate ($mil) | Sales - Fiscal Qtr. Sales Estimates |

| 215 | Q(0) Std Dev of Sales Consensus | Sales - Fiscal Qtr. Sales Estimates |

| 216 | Q(0) # Analysts in Sales Consensus | Sales - Fiscal Qtr. Sales Estimates |

| 217 | Qrtly Act Sales used in Sup ($mil) | Sales - Sales Suprises |

| 218 | Sales Suprises (%) | Sales - Sales Suprises |

| 219 | F(0) Consensus Sales Estimate ($mil) | Sales - Fiscal Yr. Sales Estimates |

| 220 | F(0) Std Dev of Sales Consensus | Sales - Fiscal Yr. Sales Estimates |

| 221 | F(0) # Analysts in Sales Consensus | Sales - Fiscal Yr. Sales Estimates |

| 222 | Q(1) Consensus Sales Estimate ($mil) | Sales - Fiscal Qtr. Sales Estimates |

| 223 | Q(1) # Analysts in Sales Consensus | Sales - Fiscal Qtr. Sales Estimates |

| 226 | F(1) Consnsus Sales Estimate ($mil) | Sales - Fiscal Yr. Sales Estimates |

| 227 | F(1) Standard Dev of Sales Consensus | Sales - Fiscal Yr. Sales Estimates |

| 228 | F(1) # Analysts in Sales Consensus | Sales - Fiscal Yr. Sales Estimates |

| 230 | Q(2) Consensus Sales Estimate ($mil) | Sales - Fiscal Qtr. Sales Estimates |

| 231 | Q(2) Std Dev of Sales Consensus | Sales - Fiscal Qtr. Sales Estimates |

| 232 | Q(2) # Analysts in Sales Consensus | Sales - Fiscal Qtr. Sales Estimates |

| 234 | F(2) Consensus Sales Estimate ($mil) | Sales - Fiscal Yr. Sales Estimates |

| 235 | F(2) Std Dev of Sales Consensus | Sales - Fiscal Yr. Sales Estimates |

| 236 | F(2) # Analysts in Sales Consensus | Sales - Fiscal Yr. Sales Estimates |

| 238 | Q(3) Consensus Sales Estimate ($mil) | Sales - Fiscal Qtr. Sales Estimates |

| 239 | Q(3) # Analysts in Sales Consensus | Sales - Fiscal Qtr. Sales Estimates |

| 240 | Q(4) Consensus Sales Estimates ($mil) | Sales - Fiscal Qtr. Sales Estimates |

| 241 | Q(4) # Analysts in Sales Consensus | Sales - Fiscal Qtr. Sales Estimates |

| 242 | Mean Est for Short-Term Target Price | Short Term Price Targets |

| 243 | Std Dev of Short-Term Target Price Estimates | Short Term Price Targets |

| 244 | # of Analysts in Price Target Consensus | Short Term Price Targets |

| 246 | Highest Short-Term Target Price | Short Term Price Targets |

| 247 | Lowest Short-Term Target Price | Short Term Price Targets |

| 248 | SIC Codes | Company - Descriptive |

| 249 | Number of Employees | Company - Descriptive |

| 250 | Last Quarter Cash Dividend per Share | Ratios - Dividend and Payout |

| 251 | Annual Cash Dividend per Share | Ratios - Dividend and Payout |

| 252 | % Chg 1 Month in Short Interest | Company - Size and Share Volume |

| 253 | % Chg 3 Month in Short Interest | Company - Size and Share Volume |

| 254 | Short Interest Relative to Shares Out | Company - Size and Share Volume |

| 257 | Q(0) Highest IR Projection | EPS - Actuals & Est. - Fiscal Qtr Est |

| 258 | Q(0) Lowest IR Projection | EPS - Actuals & Est. - Fiscal Qtr Est |

| 259 | Q(0) Date of IR Projection | EPS - Actuals & Est. - Fiscal Qtr Est |

| 260 | Q(1) Highest IR Projection | EPS - Actuals & Est. - Fiscal Qtr Est |

| 261 | Q(1) Lowest IR Projection | EPS - Actuals & Est. - Fiscal Qtr Est |

| 262 | Q(1) Date of IR Projection | EPS - Actuals & Est. - Fiscal Qtr Est |

| 263 | F(0) Highest IR Projection | EPS - Actuals & Est. - Fiscal Yr Est |

| 264 | F(0) Lowest IR Projection | EPS - Actuals & Est. - Fiscal Yr Est |

| 265 | F(0) Date of IR Projection | EPS - Actuals & Est. - Fiscal Yr Est |

| 266 | F(1) Highest IR Projection | EPS - Actuals & Est. - Fiscal Yr Est |

| 267 | F(1) Lowest IR Projection | EPS - Actuals & Est. - Fiscal Yr Est |

| 268 | F(1) Date of IR Projection | EPS - Actuals & Est. - Fiscal Yr Est |

| 270 | % Change Q(0) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 271 | % Change Q(1) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 272 | # Up Q(1) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 273 | # Down Q(1) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 274 | Q(1) Median Sales Estimate ($mil) | Sales - Fiscal Qtr. Sales Estimates |

| 275 | % Change Q(2) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 276 | Q(2) Median Sales Estimate ($mil) | Sales - Fiscal Qtr. Sales Estimates |

| 277 | % Change F(1) Sales Est - 1 Week | Sales - Sales Estimate Revisions |

| 278 | % Change F(1) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 279 | % Change F(1) Sales Est - 12 Weeks | Sales - Sales Estimate Revisions |

| 280 | # Up F(1) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 281 | # Down F(1) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 282 | F(1) Median Sales Estimate ($mil) | Sales - Fiscal Yr. Sales Estimates |

| 283 | % Change F(2) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 284 | % Change F(2) Sales Est - 12 Weeks | Sales - Sales Estimate Revisions |

| 285 | # Up F(2) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 286 | # Down F(2) Sales Est - 4 Weeks | Sales - Sales Estimate Revisions |

| 287 | F(2) Median Sales Estimate ($mil) | Sales - Fiscal Yr. Sales Estimates |

| 288 | Q(3) Std Dev of Consensus | EPS - Actuals & Est. - Fiscal Qtr Est |

| 289 | F(3) Std Dev of Consensus | EPS - Actuals & Est. - Fiscal Yr Est |

| 290 | Q(3) Std Dev of Sales Consensus | Sales - Fiscal Qtr. Sales Estimates |

| 501 | % Held by Insiders | Company - Size and Share Volume |

| 502 | % Held by Institutions | Company - Size and Share Volume |

| 503 | Exchange Ticker | Company - Descriptive |

| 504 | COM/ADR/Canadian | Company - Descriptive |

| 505 | Currency | Company - Descriptive |

| 506 | Exchange Traded | Company - Descriptive |

| 507 | Current Price/52 Week High | Price and Price Changes |

| 508 | Current Price/52 Week Low | Price and Price Changes |

| 509 | P/E (Current 5 year High) | Ratios - P/E |

| 510 | P/E (Current 5 year Low) | Ratios - P/E |

| 511 | P/E (Current 5 year Average) | Ratios - P/E |

| 512 | Volume - 20 Days/Shares Out % | Company - Size and Share Volume |

| 513 | Payout Ratio Change | Ratios - Dividend and Payout |

| 514 | % Change EPS F(-2)/F(-3) | Growth - EPS Historical |

| 515 | % Change EPS F(-1)/F(-2) | Growth - EPS Historical |

| 516 | % Change EPS F(0)/F(-1) | Growth - EPS Historical |

| 517 | 12 Mo EPS Current-1Q/Last-1Q (%) | Growth - EPS Historical |

| 518 | 12 Mo EPS Current/Last (%) | Growth - EPS Historical |

| 519 | % Change Act EPS Q(0)/Q(-1) | Growth - EPS Historical |

| 520 | % Change Act EPS Q(-1)/Q(-2) | Growth - EPS Historical |

| 521 | % Change Act EPS Q(-2)/Q(-3) | Growth - EPS Historical |

| 522 | % Change Act EPS Q(-3)/Q(-4) | Growth - EPS Historical |

| 523 | % Change Act EPS Q(-4)/Q(-5) | Growth - EPS Historical |

| 524 | % Change Act EPS Q(-5)/Q(-6) | Growth - EPS Historical |

| 525 | % Change Act EPS Q(0)/Q(-4) | Growth - EPS Historical |

| 526 | % Change Act EPS Q(-1)/Q(-5) | Growth - EPS Historical |

| 527 | % Change Act EPS Q(-2)/Q(-6) | Growth - EPS Historical |

| 528 | % Change Act EPS Q(-3)/Q(-7) | Growth - EPS Historical |

| 529 | Est One Year EPS Growth F(1)/F(0) | Growth - EPS Projected |

| 530 | Q(4) Fiscal Quarter End Date (yyyymm) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 531 | Est Two Year EPS Growth F(2)/F(0) | Growth - EPS Projected |

| 532 | Price/Sales | Ratios - Valuation |

| 533 | Est 12 mo. EPS Gr Q(1)/Year Ago | Growth - EPS Projected |

| 534 | Est 12 mo. EPS Gr Q(2)/Year Ago | Growth - EPS Projected |

| 535 | Est 12 mo. EPS Gr Q(3)/Year Ago | Growth - EPS Projected |

| 536 | Est 12 mo EPS Gr Q(4)/Year Ago | Growth - EPS Projected |

| 537 | Est EPS Gr Q(1)/Q(-3) | Growth - EPS Projected |

| 538 | Est EPS Gr Q(2)/Q(-2) | Growth - EPS Projected |

| 539 | Est EPS Gr Q(3)/Q(-1) | Growth - EPS Projected |

| 540 | Est Eps gr Q(4)/Q(0) | Growth - EPS Projected |

| 541 | F(1) Year End Date (yyyymm) | EPS - Actuals & Est. - Fiscal Yr Est |

| 542 | F(2) Year End Date (yyyymm) | EPS - Actuals & Est. - Fiscal Yr Est |

| 543 | F(3) Year End Date (yyyymm) | EPS - Actuals & Est. - Fiscal Yr Est |

| 544 | Q(1) Fiscal Quarter End Date (yyyymm) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 545 | Q(2) Fiscal Quarter End Date (yyyymm) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 546 | Q(3) Fiscal Quarter End Date (yyyymm) | EPS - Actuals & Est. - Fiscal Qtr Est |

| 547 | Est EPS Gr Q(1)/Q(0) | Growth - EPS Projected |

| 548 | Est EPS Gr Q(2)/Q(1) | Growth - EPS Projected |

| 549 | Est EPS Gr Q(3)/Q(2) | Growth - EPS Projected |

| 550 | Est EPS Gr Q(4)/Q(3) | Growth - EPS Projected |

| 551 | PEG Ratio: P/E F(1)/EPS Growth | Ratios - Valuation |

| 552 | Quick Ratio - Most Recent | Ratios - Liquidity & Coverage |

| 553 | Cash Ratio - Most Recent | Ratios - Liquidity & Coverage |

| 554 | Debt/Equity - Most Recent | Ratios - Leverage |

| 555 | % Rating Upgrades - 1 Week | Ratings - Changes |

| 556 | % Rating Downgrades - 1 Week | Ratings - Changes |

| 557 | % Rating Upgrades - 4 Weeks | Ratings - Changes |

| 558 | % Rating Downgrades - 4 Weeks | Ratings - Changes |

| 559 | # Up/# Estimates F(1) - 4 Weeks | EPS - Estimate Revisions |

| 560 | # Up/# Down F(1) Est - 4 Weeks | EPS - Estimate Revisions |

| 561 | # Up/# Estimates F(2) - 4 Weeks | EPS - Estimate Revisions |

| 562 | # Up/# Down F(2) Est - 4 Weeks | EPS - Estimate Revisions |

| 563 | (# Up-# Down)/# Est F(1) - 4 Weeks | EPS - Estimate Revisions |

| 564 | (# Up-# Down)/# Est F(2) - 4 Weeks | EPS - Estimate Revisions |

| 565 | Last EPS Surprise (%) | EPS - Suprises and SUE |

| 566 | Previous EPS Surprise (%) | EPS - Suprises and SUE |

| 567 | Change in EPS Surprise (last-prev) | EPS - Suprises and SUE |

| 568 | Avg EPS Surprise - Last 2 Quarters | EPS - Suprises and SUE |

| 569 | Avg EPS Surprise - Last 4 Quarters | EPS - Suprises and SUE |

| 570 | Last SUE | EPS - Suprises and SUE |

| 571 | Previous SUE | EPS - Suprises and SUE |

| 572 | Change in SUE (Last-Previous) | EPS - Suprises and SUE |

| 573 | Average SUE - Last 2 Quarters | EPS - Suprises and SUE |

| 574 | Sales Growth F(0)/F(-1) | Growth - Sales |

| 575 | 12 Mo Sales Current/Current-1Q (%) | Growth - Sales |

| 576 | 12 Mo Sales Current/Last (%) | Growth - Sales |

| 577 | % Change Sales Q(0)/Q(-4) | Growth - Sales |

| 578 | % Change Sales Q(0)/Q(-1) | Growth - Sales |

| 579 | % Change Sales Q(-1)/Q(-2) | Growth - Sales |

| 580 | % Change Sales Q(-2)/Q(-3) | Growth - Sales |

| 581 | % Change Sales Q(-3)/Q(-4) | Growth - Sales |

| 582 | % Change Sales Q(-4)/Q(-5) | Growth - Sales |

| 583 | % Change Sales Q(-5)/Q(-6) | Growth - Sales |

| 584 | % Change Sales Q(-1)/Q(-5) | Growth - Sales |

| 585 | % Change Sales Q(-2)/Q(-6) | Growth - Sales |

| 586 | % Change Sales Q(-3)/Q(-7) | Growth - Sales |

| 587 | # Down/# Estimates F(1) - 4 Weeks | EPS - Estimate Revisions |

| 588 | # Down/# Estimates F(2) - 4 Weeks | EPS - Estimate Revisions |

| 589 | Net Income Growth F(-1)/F(-2) | Growth - Net Income |

| 590 | Net Income Growth F(0)/F(-1) | Growth - Net Income |

| 591 | 12 Mo. Net Inc Current-1Q/Last-1Q (%) | Growth - Net Income |

| 592 | 12 Mo. Net Income Current/Last (%) | Growth - Net Income |

| 593 | % Change Net Income Q(0)/Q(-1) | Growth - Net Income |

| 594 | % Change Net Income Q(-1)/Q(-2) | Growth - Net Income |

| 595 | % Change Net Income Q(-2)/Q(-3) | Growth - Net Income |

| 596 | % Change Net Income Q(-3)/Q(-4) | Growth - Net Income |

| 597 | % Change Net Income Q(-4)/Q(-5) | Growth - Net Income |

| 598 | % Change Net Income Q(-5)/Q(-6) | Growth - Net Income |

| 599 | % Change Net Income Q(0)/Q(-4) | Growth - Net Income |

| 600 | % Change Net Income Q(-1)/Q(-5) | Growth - Net Income |

| 601 | % Change Net Income Q(-2)/Q(-6) | Growth - Net Income |

| 602 | % Change Net Income Q(-3)/Q(-7) | Growth - Net Income |

| 603 | Change in ROE (12 mo-5 year average) | Ratios - Return on Investment |

| 604 | Change in ROA (12 mo-5 year average) | Ratios - Return on Investment |

| 605 | Change in ROI (12 mo-5 year average) | Ratios - Return on Investment |

| 607 | Change in Net Margin (12 mo-5Yr Avg) | Margins |

| 608 | Change in Oper. Mgn. (12 mo-5Yr Avg) | Margins |

| 609 | Change in Rec. Turn. (12 mo-5 Yr Avg) | Ratios - Turnover |

| 610 | Change in Inv. Turn. (12 mo-5 Yr Avg) | Ratios - Turnover |

| 611 | Change in Asset Util. (12 mo-5 Yr Avg) | Ratios - Turnover |

| 612 | Change in Debt/Tot.Cap. (Rec-5Yr Avg) | Ratios - Leverage |

| 613 | Change in Current Ratio (Rec-5Yr Avg) | Ratios - Liquidity & Coverage |

| 614 | % Rating Strong Buy | Ratings - Current |

| 615 | % Rating Buy | Ratings - Current |

| 617 | % Rating Hold | Ratings - Current |

| 618 | % Rating Sell | Ratings - Current |

| 619 | % Rating Strong Sell | Ratings - Current |

| 620 | % Rating Buy + Strong Buy | Ratings - Current |

| 621 | % Rating Change - 1 Week | Ratings - Changes |

| 622 | % Rating Change - 4 Weeks | Ratings - Changes |

| 623 | #(Up-Down Rating)/Total - 1 Week | Ratings - Changes |

| 624 | #(Up-Down Rating)/Total - 4 Weeks | Ratings - Changes |

| 625 | St Dev Q(1)/Consensus Q(1) | Ratios - Valuation |

| 626 | St Dev Q(2)/Consensus Q(2) | Ratios - Valuation |

| 627 | St Dev F(1)/Consensus F(1) | Ratios - Valuation |

| 628 | St Dev F(2)/Consensus F(2) | Ratios - Valuation |

| 629 | F(1) Range: (High-Low)/Consensus | Ratios - Valuation |

| 630 | F(2) Range: (High-Low)/Consensus | Ratios - Valuation |

| 632 | Market Value/# Analysts | Ratios - Valuation |

| 633 | Sales/# Analysts | Ratios - Valuation |

| 634 | Extreme F(1): Mean/Median | Ratios - Valuation |

| 635 | Extreme F(2): Mean/Median | Ratios - Valuation |

| 636 | Est.YTD EPS Gr. Q(1)/YTD Year ago | Growth - EPS Projected |

| 637 | Est YTD EPS Gr. Q(2)/YTD Year ago | Growth - EPS Projected |

| 638 | Est YTD EPS Gr. Q(3)/YTD Year ago | Growth - EPS Projected |

| 639 | Est YTD EPS Gr. Q(4)/YTD Year ago | Growth - EPS Projected |

| 642 | 12 Month Forward Looking Estimate | EPS - Actuals & Est. - Fiscal Yr Est |

| 645 | 12 Mo. Forward Estimate/12 Mo. Actual | Growth - EPS Projected |

| 646 | P/E using 12 mo. Forward EPS Estimate | Ratios - P/E |

| 647 | # Up/# Estimates Q(1) - 4 Weeks | Sales - Sales Estimate Revisions |

| 648 | # Down/# Estimates Q(1) - 4 Weeks | Sales - Sales Estimate Revisions |

| 649 | # Up/# Sales Estimates F(1) - 4 Weeks | Sales - Sales Estimate Revisions |

| 650 | # Down/# Sales Estimates F(1) - 4 Weeks | Sales - Sales Estimate Revisions |

| 651 | # Up/# Sales Estimates F(2) - 4 Weeks | Sales - Sales Estimate Revisions |

| 652 | # Down/# Sales Estimates F(2) - 4 Weeks | Sales - Sales Estimate Revisions |

| 660 | Shares Outstanding Float (mil) | Company - Size and Share Volume |

| 700 | Net % Change Holdings - 12 Wks | Company - Size and Share Volume |

| 701 | # of Buyers - 12 Wks | Company - Size and Share Volume |

| 702 | # of Sellers - 12 Wks | Company - Size and Share Volume |

| 704 | Net % Change Holdings - 24 Wks | Company - Size and Share Volume |

| 705 | # of Buyers - 24 Wks | Company - Size and Share Volume |

| 706 | # of Sellers - 24 Wks | Company - Size and Share Volume |

| 901 | S&P 500 Membership and Industry | Company - Descriptive |

| 902 | S&P 400 Membership and Industry | Company - Descriptive |

| 903 | S&P 100 Membership and Industry | Company - Descriptive |

| 904 | S&P 600 Membership and Industry | Company - Descriptive |

| 905 | Options Exist | Company - Descriptive |

By the way, the answer to what were the items the Calculation Expression using in preceding example of: i106 >= i170 is:

106 = Item: Cash Flow ($/share)

Category: Ratios – Valuation

i170 = Item: 5 Year Average Cash Flow ($/share)

Category: Growth – Dividend and Book

This was pretty easy to find with the above Reverse Lookup Table wasn't it?

Summary

Simply bookmark this page for quick and easy access or copy and paste this table into your own Excel spreadsheet so you can have your own copy for even easier access.

The Research Wizard – power and convenience all at your fingertips.

Free Daily Picks from Zacks' Best Strategies

Plus, Formulas for Finding Them on Your Own

Try our Research Wizard stock-selection program for 2 weeks to access live picks from our proven strategies, modify existing screens, or test and create your own at the touch of a button. Absolutely free and no credit card needed.